Las Vegas hotels battle steep summer slump with aggressive promotions

Occupancy plunges nearly 17% as international visitors vanish and economic uncertainty dampens demand

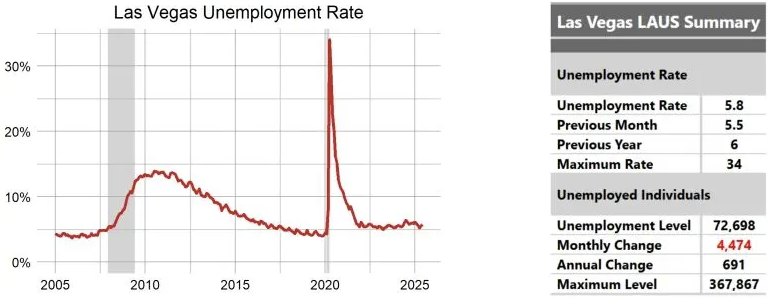

Las Vegas hotels are experiencing their worst summer performance in years, with occupancy rates plummeting and revenue per available room (RevPAR) falling by nearly 30% in early July, prompting properties across the Strip to launch unprecedented promotional campaigns to fill empty rooms.

The dramatic decline is so severe that Las Vegas alone is dragging down the entire U.S. hotel industry’s performance metrics, according to data analytics firm STR.

The numbers tell a stark story

Preliminary STR data reveals the depth of the crisis:

- June occupancy fell 14.9%, marking the city’s steepest monthly decline of 2025

- The week ending July 5 saw occupancy plunge 16.8% to just 66.7%

- RevPAR crashed 28.7% to $102.75 during the same period

- Without Las Vegas, U.S. hotel RevPAR would have been flat rather than negative

The downturn accelerated from May, when the Las Vegas Convention and Visitors Authority (LVCVA) reported visitor volume had already declined 6.5% year-over-year to 3.4 million visitors.

International visitors disappear

A primary driver of the decline is the sharp drop in international arrivals, particularly from Canada—traditionally one of Las Vegas’s most important feeder markets. According to U.S. International Air Travel Statistics, overseas arrivals to Las Vegas have fallen consistently throughout 2025, with only January showing growth.

The decline accelerated dramatically in June, when international visitor arrivals plummeted 13.2%. Canadian visitors, who contributed 1.8 million passengers via six airlines in 2024 and represented nearly half of all international arrivals at Harry Reid International Airport, have been particularly absent.

“The level of uncertainty is dramatically higher today than it was six months ago,” said Stephen Miller, director of research at the Center for Business and Economic Research at UNLV. “A drop in international visitors, particularly from Canada, is a primary culprit.”

Economic headwinds compound seasonal softness

While Las Vegas typically experiences slower periods during the hot summer months, industry experts say this year’s decline goes beyond normal seasonal patterns. Rising inflation, economic uncertainty, and shifting consumer spending habits have made travelers more cautious about discretionary spending.

LVCVA CEO Steve Hill acknowledged that economic challenges are “a national phenomenon” affecting leisure travel broadly. “The uncertainty that’s been added lately has caused those who are budget conscious, which is most of us, to think twice,” he said.

John DeCree, head of institutional investor research at CBRE Capital Advisors, views the trends as part of a natural market cycle after years of pent-up demand following the pandemic. However, the severity of the decline has caught many by surprise.

Hotels fight back with unprecedented promotions

Facing empty rooms and plunging revenues, Las Vegas properties have launched aggressive promotional strategies not seen in years:

Resorts World Las Vegas unveiled its “All Resort, No Fees” package, eliminating resort fees through early September and including:

- Complimentary self-parking

- Nightly resort credits of $50 at Hilton and Conrad hotels

- $75 credits at the luxury Crockfords hotel

“We knew very early on, when we started to see some softness, that we were going to need to get innovative,” said Shannon McCallum, vice president of hotel operations at Resorts World.

Other notable promotions include:

- Sahara Las Vegas: Choice to eliminate resort fees or receive $50 daily dining credit

- Caesars Entertainment: 15% discount on rooms, 20% off spa and attractions

- The Strat: Summer of Value package with $49 midweek/$99 weekend rates including resort fees and Tower Observation Deck admission for two

- Circa Resort & Casino: $400 All-In Summer Package with two-night stay and $200 in dining credits

LVCVA responds with marketing blitz

The tourism authority has responded with a 30% boost in annual marketing spending—the biggest increase in both percentage and dollar terms in the organization’s history. The campaign emphasizes that “Las Vegas has an offering for every budget,” while tripling investment with some online travel agencies.

“Our resort partners are pretty exceptional at understanding how to turn the knobs in order to achieve the outcome that’s possible in the current environment,” Hill said, noting that different properties are taking varied approaches to the challenge.

Hope on the horizon

Despite the current challenges, industry leaders remain cautiously optimistic about the fall and winter seasons. Several positive indicators suggest the slump may be temporary:

- Convention attendance actually rose 10.7% year-over-year in May

- The city’s meetings and trade show schedule through 2026 remains “very strong”

- Forward bookings for late 2025 and 2026 show strength in events and groups

DeCree emphasized that group business represents “a much bigger piece of the profit pool in Vegas than short-term leisure travelers,” adding that any negative trends in group booking pace would be more concerning than the current leisure softness.

Long-term implications

The current downturn highlights Las Vegas’s vulnerability to international travel patterns and economic uncertainty. With hotel occupancy rates that typically exceed 85%, even a modest decline can significantly impact the city’s tourism-dependent economy.

For travelers, the aggressive discounting presents rare opportunities to experience Las Vegas at reduced prices, particularly during midweek stays. However, visitors should be prepared for triple-digit temperatures and potentially reduced services as properties adjust staffing to match lower occupancy.

As the city navigates through what Hill describes as a “relatively soft summer,” the true test will come in the fall when convention season ramps up and cooler weather returns. Whether international visitors—particularly Canadians—return in force will be crucial to determining if this is merely a temporary setback or the beginning of a longer-term adjustment in one of America’s premier tourist destinations.

Image Sources: https://www.travelweekly.com/Travel-News/Hotel-News/Las-Vegas-hotels-grapple-with-steep-occupancy-decline

Category: Business

Subcategory: Tourism & Travel

Date: 07/29/2025